Avoid These Startup Mistakes to Maximize Commercial Islamic Financing

Seeking funds to fuel a startup business can be tricky for many Muslim entrepreneurs, especially when opting for one that aligns with their ethical beliefs. Good thing that ijaraCDC offers investor-led commercial Islamic financing programs to assist Muslim businesses in getting their startups on the right track.

But how should a startup prepare for success? Don’t worry, we got you covered. Here are some common mistakes you should skip to ensure your business goals are within reach.

Mistake #1: Not Creating a Business Plan

Forgetting to make a business plan is another big mistake that can cost your business in the long run. Many rookies forget how important it is to have one of these. They don’t need to be detailed or very long.

However, taking the time necessary to chart a path forward will help keep your business efforts on a consistent level. Not only that, but a good business plan also serves as a set of benchmarks for your team and helps to measure your progress.

Mistake #2: Lowballing Your Budget

Not having the right financing at the start is another common misstep. Don’t lowball the amount of capital that you’ll need to get your business started. The result can be inadequate financing and a cash squeeze that starts as soon as your enterprise begins to run.

To avoid this speedbump, put together a series of financial projections for the first 12 months of your business. These will also help you get financing and investors.

Mistake #3: Using Cash Flow to Buy Assets

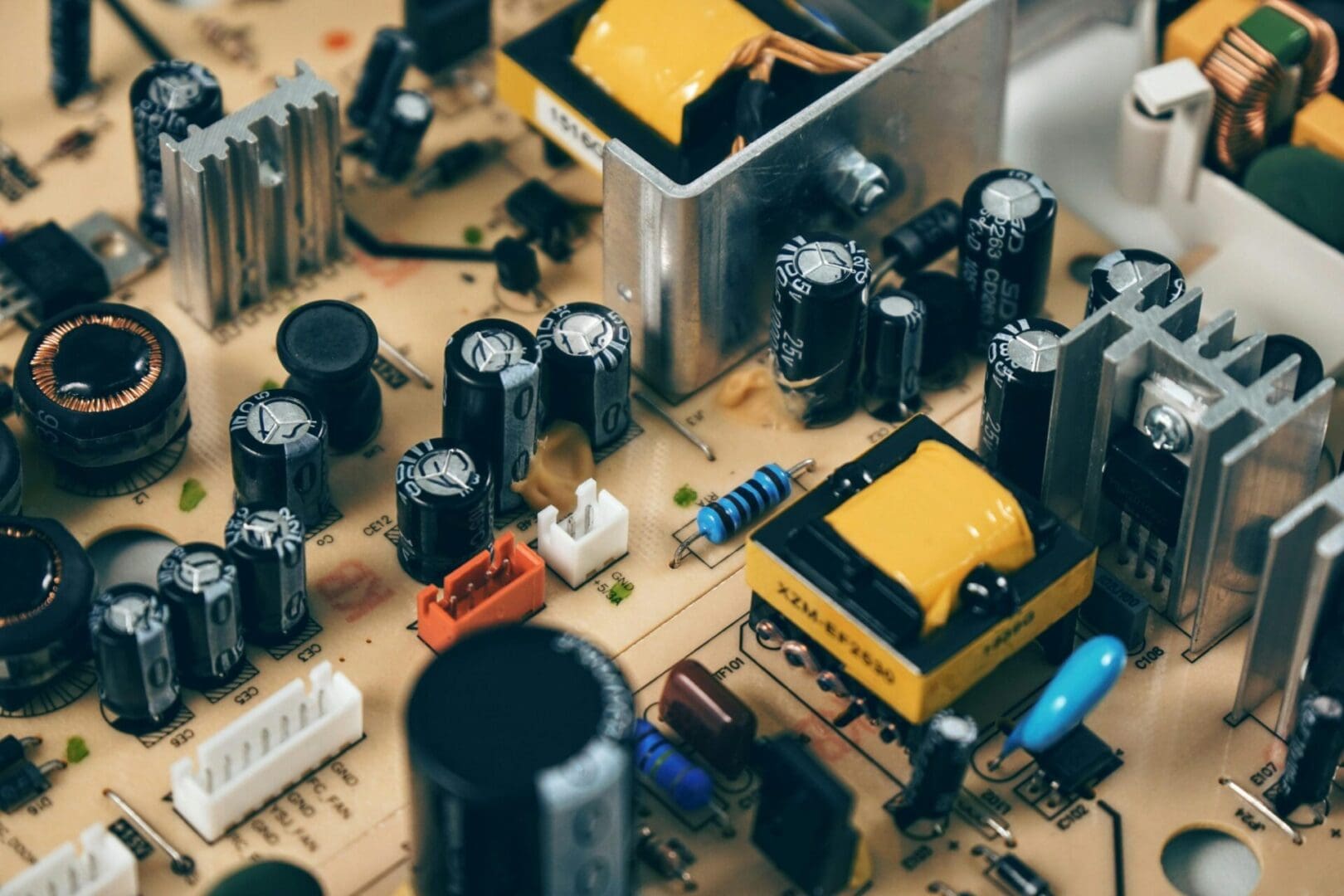

Then there’s buying assets with the money that you set aside for your cash flow. Using operating cash to pay for different kinds of long-term assets can result in a cash shortage.

It’s much better to use business loans to look after major purchases like machinery or equipment. Going with this route will make sure you have enough funds available for immediate needs while maintaining a stable cash flow on your business.

Mistake #4: Staying Old-School

One of the other big mistakes you can make is ignoring technology. It’s important to consider how the latest innovations pay off in the long run with improved profitability, efficiency and growth.

We recommend staying updated on the latest technology and see how you can adopt it on your business strategy. Investing on these innovations will guarantee your startup will continue to flourish and stay competitive.

You made a smart move by choosing commercial Islamic financing for your startup. Don’t ignore the marketing capabilities of the Internet. It’s easy to target specific markets on social media platforms. It’s a cost-effective way to get the word out on your brand-new enterprise. As your business grows, you should learn from any of the mistakes you make along the way.