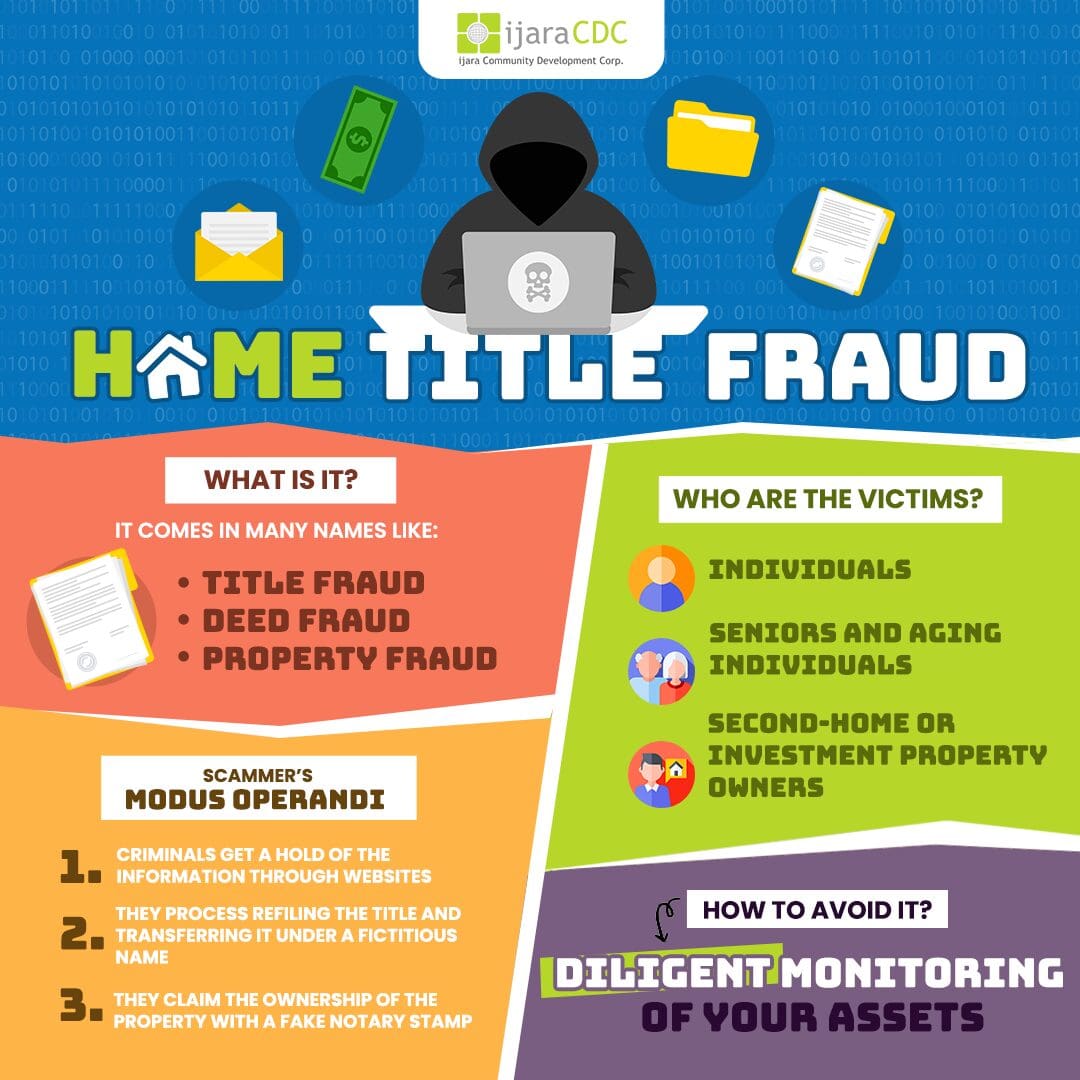

How to Avoid Home Title Fraud

Owning a property comes with a big investment from you or your predecessors. Whether you are the first owner or got the property through an inheritance, homes have a significant value for the owners. However, some people scam property owners across the country the FBI calls it “house stealing” or “home title fraud.”

So, let us talk about this issue and how to solve it.

What Is Home Title Fraud?

It comes in many names like title fraud, deed fraud, & property fraud, and this occurs when someone falsely changes the owner’s name of a certain property and uses it for nefarious reasons. Mainly the con is taking a loan and using the title as the collateral then vanishes.

As the loan compounds with interest, the real owner will be notified about the loan they did not make. But it is all too late as the bank or lending company provides them with a warning as their property is the collateral. As a result, the true owners will undergo an expensive legal process to reclaim their land and release them from the debt of their property that was fraudulently used.

Modus Operandi

Information now is accessible by law enforcement and criminals through the World Wide Web. With the right tools criminals can access personal data like homeowner information online as many documents are now available in digital format.

The M.O. for the home title fraud scam is complex but with the right access, the scammer can easily get the information they need.

First, criminals get a hold of the information through websites, this includes your property title, primary contact details, and even an electronic signature. Then they process refiling your title transferring it under a fictitious name and claiming ownership of the property with a fake notary stamp.

Once they already claimed the property, they will do whatever they want. They profit by using the property title as collateral for a loan, refinancing an existing one, or inheriting the property after the owner’s death.

As they profit from your property they vanish with the original owner oblivious about the debts and sometimes unwanted tenants in their property. They will only know their property was used fraudulently when it is too late.

The victim will receive notice that their property is a foreclosure or discover someone is living on their property that they are rarely visiting. Trying to fix these problems the owner will spend time and money on the thousands or sometimes hundreds of thousands of legal fees.

Who Are the Victims?

These con men target vulnerable homeowners which is generally anyone who owns one, the reason is that property titles are public documents and readily accessible online. They target individuals that have full equity in their property to ensure less scrutiny if they will apply it as collateral or potential lessor/ tenants.

The fraud targets the following individuals:

- Individuals who fully own a property or several properties.

- Individuals with high equity

- Seniors and aging individuals who have high equity in their property

- Second-home or investment property owners who are paying less attention to their properties

These individuals are likely targeted, because of the high payouts from their properties.

What Can You Do to Avoid Home Title Fraud?

Property owners need to be proactive in protecting their property. Though property titles are public documents; diligent monitoring of your assets ensures everything is in order and protects you from scammers.